The United Arab Emirates has introduced corporate tax regime, making a significant progress in its tax policy. Effective from June 2023, the new corporate tax laws impose a standard rate of 9% on taxable income exceeding AED 375,000, aiming to align with global tax standards and reduce dependence on oil revenues.

Announced

Introduced through Federal Decree-Law No. (47) of 2022

Scope

Across UAE for all Incorporated Businesses and specified Natural Persons

Small Business

Small Business Relief of 0% tax for Turnover up to AED 3 million

Rate

Standard rate of 9% on Taxable Income exceeding AED 375,000

FreeZones

Qualifying Freezone Persons are subject to 0% taxation

Effective Date

Applicable for Fiscal Year starting from June 1, 2023

Please let us know if you have a question, want to leave a comment, or would like further information about our company.

Consulting theme is an invaluable partner. Our teams have collaborated to support the growing field of practitioners using collective impact.

Our Corporate Tax advisory services can help businesses with all the processes and procedures. We also provide ongoing support and assistance with assessment, compliance, administration, and other aspects of the Corporate Taxes in the UAE.

At BRISK Accounting & Auditing, we specialize in navigating these new regulations. Our team of seasoned tax professionals is equipped with deep knowledge of both UAE corporate tax laws and international taxation principles, ensuring that your business leverages the best possible tax strategies while maintaining full compliance.

REGISTRATION

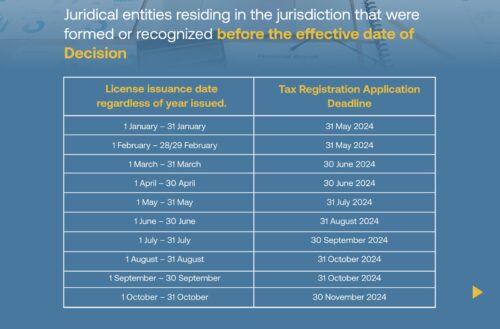

Under the UAE Corporate Tax (CT) Law, the Federal Tax Authority (FTA) aligns the timeline for Tax Registration with the issuance date of the business license. FTA issued Decision No.3 of 2024, where taxable persons are provided from 1 to 3 months of time from their license renewal date. The first deadline being May 31, 2024 applicable for license anniversary dates falling between January 1 to February 29. For entities holding multiple licenses, the one with the earliest issuance date is designated for tax registration purposes. This connection between license issuance and tax obligations underscores the importance of timely compliance with UAE’s corporate tax regulations. Businesses should ensure they understand and follow these guidelines to remain compliant and avoid potential penalties.

TAX RATES

FTA has introduced one of the lowest Corporate Tax rates in the world.

– Taxable income < AED 375,000: Applicable Tax Rate – 0%

– Taxable income > AED 375,000:Applicable Tax Rate – 9%

– Separate rate for large organizations subject to pillar two rule

– Qualifying free zone person: Applicable Tax Rate – 0%

Small Business Relief:

– Turnover < AED 3,000,000: Applicable Tax Rate – 0%

Exemptions:

– UAE Government and Government Controlled Entities

– Persons engaged in Extractive & Natural Resources Business

– Public Benefit entities and Qualifying Investment Funds – Pension Plans

– Businesses that are Wholly Owned by Exempt Person

Send A Message

CORPORATE TAX SERVICES

Our team of professionals works with you every step of the way to ensure compliance and success for your business.

We offer a comprehensive suite of services designed to ensure full compliance and optimal tax management.

Our team will handle all the formalities related to Corporate Tax Registration to provide a hassle free experience. Whether it comes to creating, updating or modifying the EmaraTax Portal for your business, our team will ensure everything is executed in a professional manner.

Corporate and Deferred Tax Assessment includes Evaluating your business’s tax compliance and identifying any modifications required in business operations/processes. Determining Deferred Tax assets or liabilities resulting from deductible/taxable temporary differences. This could include review of existing Chart of Accounts of the company to assess compliance with Corporate Tax law & regulations. Review and recommendation on business processes and how transactions and events are captured to ensure compliance and accuracy.

Implementation includes Strategically applying Tax laws and Regulations to your business operations minimizing impact of the new regime. This could include drafting a step by step guide for business to follow in terms of business restructuring, registration, compliance and filing processes.

Our team can help with Determining applicable Tax and prepare the tax return while maximizing deductions for our clients. This would include identifying any deductions not claimed by the client or where maximum benefit is not utilized.

Our team can help with Correspondence with Federal Tax Authority for various business needs. We can also hep our clients with any tax related disputes or fines from FTA. These services would further include any case based analysis for a unique business arrangement, transfer pricing valuation, disputes regarding form and context of master file and data file, so on and so forth.

Why Engage Tax Experts

Expertise

BRISK's experts have in-depth knowledge of UAE tax laws and regulations. We can provide accurate and reliable advice on minimizing tax liabilities while staying compliant with regulations.

Time-saving

Outsourcing corporate tax services can save you time and resources. BRISK's professionals can handle all tax-related tasks, including filing returns, preparing financial statements, and responding to tax authorities' inquiries.

Better decision making

We provide valuable insights into your company's financial health and help you make informed decisions about investments, mergers and acquisitions, and other business matters.

How our Tax Advisory works

Consultation

The first step is a consultation with a tax professional to assess the company's tax situation and identify any areas of concern.

Planning

A tax plan is developed that takes into account the company's goals, income, expenses, and potential deductions or credits.

Preparation

The tax plan is then implemented by preparing and filing tax returns, including any required schedules or attachments.

Compliance

Once the tax returns are filed, ongoing compliance is necessary to ensure that the company remains in compliance with tax laws.

Review

Regular reviews and assessments are conducted to ensure that the tax plan remains appropriate and effective as the company's needs.

Why choose BRISK Accounting & Auditing

Expertise

Our professionals have expertise in UAE tax laws and regulations.

Customization

We offer customized solutions tailored according to your business needs.

Timely Services

BRISK delivers on time to avoid penalties and other legal consequences.

Reputation

BRISK has a good reputation in the industry, with positive reviews and testimonials.

Cost-effective

Best affordable solutions, ensuring they align with your budget while maintaining high-quality services.

Approachable

To ensure timely & high-quality services, we are always a phone call away to answer any of your questions.

request for proposal

BRISK Advisory Services

Financial Planning

Helps individuals and businesses in achieving their financial goals by developing a customized financial plan that considers their unique circumstances and financial objectives.

Risk Management

Helps clients identify potential risks and develop strategies to mitigate them. Risk management experts work closely with clients to identify and evaluate risks and develop plans to address them.

Mergers and Acquisitions

Helps clients in navigating complex transactions. Our team has extensive experience in all aspects of M&A, including due diligence, negotiations, and post-merger integration.

Business Strategy

Develop and implement strategic plans that align with your long-term goals. Our team helps identify growth opportunities, optimizes operations, and develops effective marketing strategies.

Technology Advisory

Help businesses leverage technology to drive growth and increase efficiency. We assist in identifying the right technology solutions for your business and provide guidance on implementation and adoption.

Regulatory Compliance

Help businesses stay compliant with the complex regulatory environment. We provide guidance on regulatory compliance and help develop compliance programs to ensure ongoing adherence.

Corporate Tax (CT) is a direct tax applied to the net income or profit generated by corporations and various types of businesses. It is also known as “Business Profits Tax” or “Corporate Income Tax” in different regions.

The introduction of a Corporate Tax regime in the UAE aligns with global best practices, enhancing its appeal as an investment and business destination. It supports the UAE’s growth and strategic objectives, while also demonstrating commitment to international tax standards and transparency

Corporate tax will take effect in the UAE for fiscal years starting on or after June 1, 2023. For example, a business with a fiscal year beginning on July 1, 2023, will be subject to corporate tax from that date.

It appears that the UAE’s corporate tax will be applied uniformly across all emirates, as it is a federal tax.

Businesses involved in specific activities like natural resource extraction might pay Emirate-level taxes. Some businesses may have obligations for both Emirate-level taxes and corporate tax, but taxes paid at the Emirate level cannot be used to offset corporate tax.